Contents

Upward and Downward Attribution Rules (Form 5471)

One of the most complicated aspects of owning a foreign business is the rules involving attribution and constructive ownership. With attribution, the concept is that a US person not the direct chain of ownership (not limited to individuals) is considered to be the owner of certain stock that another person already owns – such as a spouse or other company – based on the relationship between the person and the direct owner. The reason why this is so important is that because of the attribution rules, a person who does not directly own a foreign corporation (but who may be considered a constructive owner of the foreign corporation) may now have various reporting requirements on Form 5471 – which is probably one of the most if not the most complicated international information reporting forms out of all the different forms a taxpayer may have to file as a result of owning or having signature authority over foreign assets. Let’s take a brief introductory look at the upward and downward attribution rules as they impact four 5471.

Section 318(a)(2)(A) – Constructive Ownership of Stock

-

-

-

(2) Attribution from partnerships, estates, trusts, and corporations

-

(A) From partnerships and estates Stock owned, directly or indirectly, by or for a partnership or estate shall be considered as owned proportionately by its partners or beneficiaries

-

-

-

Section 958(b) – Rules for Determining Stock Ownership

-

-

-

(b) Constructive ownership

-

For purposes of sections 951(b), 954(d)(3), 956(c)(2), and 957, section 318(a) (relating to constructive ownership of stock) shall apply to the extent that the effect is to treat any United States person as a United States shareholder within the meaning of section 951(b), to treat a person as a related person within the meaning of section 954(d)(3), to treat the stock of a domestic corporation as owned by a United States shareholder of the controlled foreign corporation for purposes of section 956(c)(2), or to treat a foreign corporation as a controlled foreign corporation under section 957, except that—

-

(1) In applying paragraph (1)(A) of section 318(a), stock owned by a nonresident alien individual (other than a foreign trust or foreign estate) shall not be considered as owned by a citizen or by a resident alien individual.

-

(2) In applying subparagraphs (A), (B), and (C) of section 318(a)(2), if a partnership, estate, trust, or corporation owns, directly or indirectly, more than 50 percent of the total combined voting power of all classes of stock entitled to vote of a corporation, it shall be considered as owning all the stock entitled to vote.

-

(3) In applying subparagraph (C) of section 318(a)(2), the phrase “10 percent” shall be substituted for the phrase “50 percent” used in subparagraph (C). Paragraph (1) shall not apply for purposes of section 956(c)(2) to treat stock of a domestic corporation as not owned by a United States shareholder.

-

-

-

-

Upward Attribution

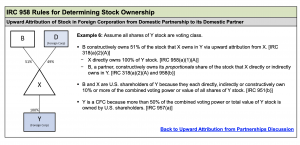

Example 6 from the government publication on Internal Revenue Code section 958 provides an example of how upward attribution works:

-

-

-

In this scenario, B is a US person and D is a foreign corporation. Together, they own 100% of X — and X owns 100% of foreign corporation Y. In thishis type of scenario, and in accordance with Internal Revenue Code sections 318 and 958, B the US partner constructively owns the proportionate share of stock that X directly owns in Y.

-

Noting, that since B owns 51% of X, it means B is attributed to owning 51% of Y. Y is considered a Controlled Foreign Corporation because it is owned by 51% by a US person who is considered a US shareholder since the owns 10% or more as defined in the code.

-

-

Downward Attribution

Since downward distribution is a bit more complex, we have summarized two of the IRS’ examples below:

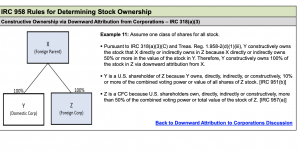

Example 6 (Corporation)

Example 6 (Corporation)

In this example, Y is deemed to constructively own stock that X directly owns in Z (a foreign corporation)

IRC 318(a)(C)

-

-

-

(C) From corporations

-

If 50 percent or more in value of the stock in a corporation is owned, directly or indirectly, by or for any person, such person shall be considered as owning the stock owned, directly or indirectly, by or for such corporation, in that proportion which the value of the stock which such person so owns bears to the value of all the stock in such corporation.

-

-

-

Using the example above, Y would be considered to be a US shareholder of Z, because based on the attribution through X, Y would be a 10% or more shareholder. Therefore, Z is considered a Controlled Foreign Corporation because US shareholders own more than 50% of the combined voting or value of the stock.

Golding & Golding: International Tax Lawyers Worldwide

Our FBAR Lawyer team specializes exclusively in international tax, and specifically IRS offshore disclosure.

Contact our firm today for assistance.